Chapter 3: Budgeting for New Technology

After determining what equipment and software are needed, the next step is to decide how much to spend, how to best acquire it, and what vendors best met the business’s criteria.

How much to spend

No business has unlimited resources. For technology acquisition it is critical to determine your needs and return on investment (ROI). Some additional considerations include:

- Which choices cover most of the businesses needs? Multiple platforms can lead to lost data and increased potential for downtime and compatibility issues.

- What choices make the most sense from a user-need standpoint? The technology should unnoticeable to customers and users.

Some considerations to consider from a business and asset standpoint include:

- Existing skill levels and experience of personnel

- Compatibility with current technology

- Physical space available to house new hardware

- Access to needed service providers and local telecommunications

Leasing

Leasing can be a good option if you need to quickly get a lot of equipment, if the equipment you need is very expensive, or has a relatively short usable life. Sometimes software is only available as a subscription or “leasing” model. Leasing can be useful for equipment because there is no need to dispose of the equipment at the end of its useful life. Commercial space can also be leased, so you can rent a place to run your business. In some cases, leasing can actually be less expensive than purchasing with a high-interest loan.

Some leasing benefits:

- Less cash or credit needed upfront

- Short-term leases allow for a way to test out the equipment

- Maintenance is sometimes included at no extra cost

- Lease payments for business assets are typically tax deductible

Potential leasing disadvantages:

- The lifetime cost is normally higher than buying

- Replacing it when the lease is up could be expensive

- Depreciation of leased assets typically are not tax deductible

- Every lease is structured differently. It is import to look carefully at the details of the each agreement

Confirming the details of a lease

There are two general kinds of leases; operating and capital. Since the accounting treatment is different, the kind of lease can have a significant impact on taxes.

Operating lease

- Works like a traditional rental

- Does not get added to the business’s balance sheet

- Payments are operational expenses

- Low maintenance, risk, or tax obligations

Capital lease

- Works more like a loan

- Asset is “owned” for accounting purposes

- Added to the balance sheet

- It is possible to claim depreciation and interest expenses

- Requires all maintenance, risk, and tax obligations

There are other considerations. Leases sometimes have buyout options that let you fully purchase the asset at the end of the lease. The length of a lease can vary, and shorter leases typically have higher monthly payments. There are often steep early-termination penalties for leaving the lease early.

It would be worthwhile to have an attorney review a lease before signing, especially if any of the terms or conditions are unclear.

Buying

Buying equipment is a good option if there is enough cash or credit available and will be using the assets for a long time.

Buying benefits:

- Depreciation is claimable for taxes

- The lifetime cost to buy is usually less than leasing

- The equipment is an asset on the balance sheet

Buying disadvantages:

- More cash or credit needed upfront

- There is less opportunity to “test out” the asset

- Business is fully liable for maintenance and replacement

Buying with cash or credit

If you buying assets with cash, they are owned in-full right away. But it also means there is less cash available to cover operating expenses. It is important to do the accounting legwork to make sure it is feasible to pay with cash.

Loans have some of the same benefits of leases by distributing the total cost over a longer period. However, there are more fees and interest than buying outright with cash.

It is also possible to leverage lines of credit with a bank, or look for other sources to get more funding.

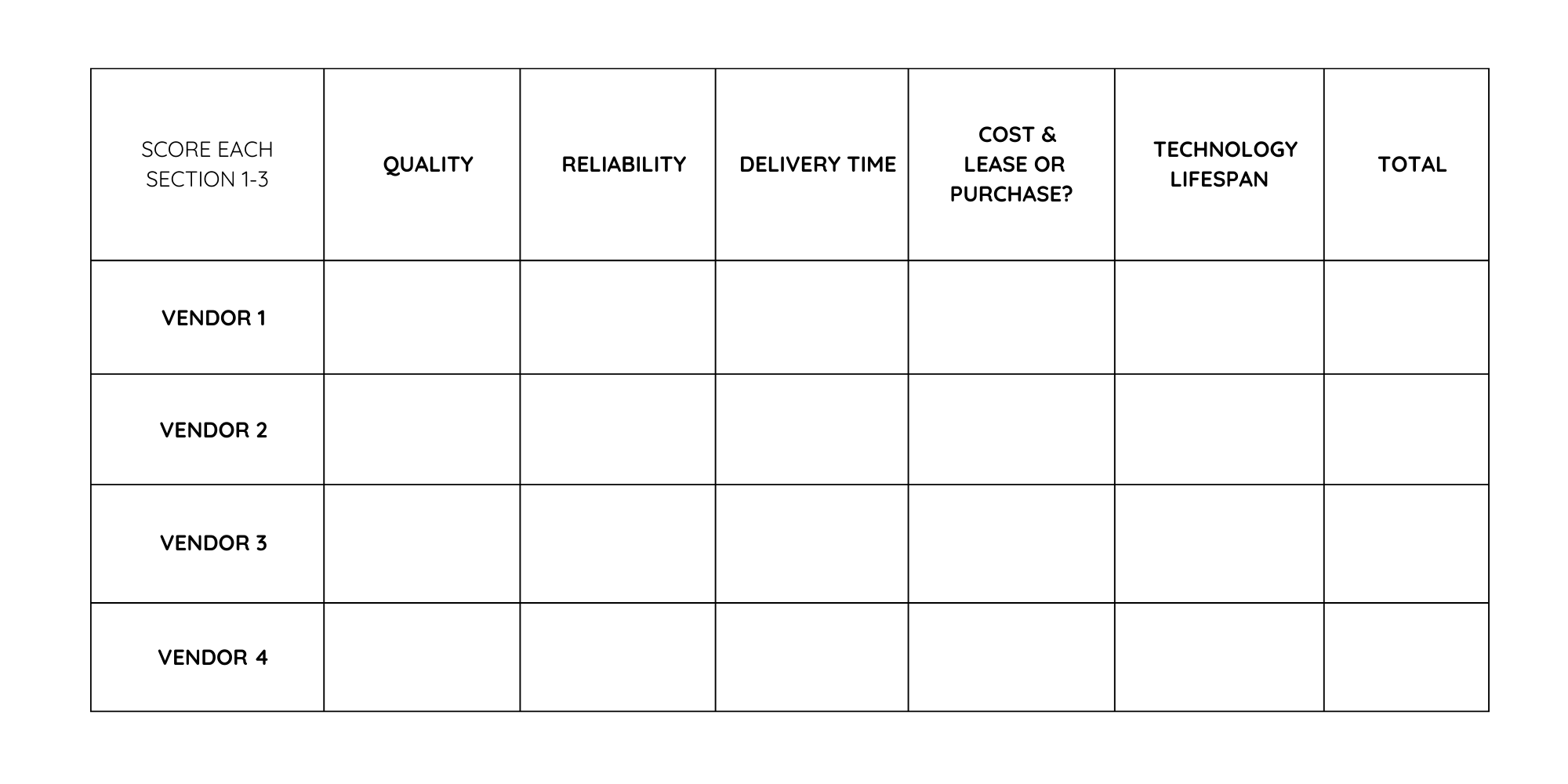

Vendor decision making process

When making any decision involving multiple points of consideration and potential vendors, sometimes it is best to quantify different aspects of the choice. In addition to a traditional spreadsheet, an excellent way to do do this is with a decision matrix. It is a simple, but powerful, tool to help budget managers and stakeholders to narrow down the options and provide clarity.

Each project has different factors to consider. Below is a sample of one way to organize the data:

Purchasing surplus goods from the government is an option to consider. Just about any tangible asset a business might need is sold by the government at or below the price on the open market.

When a federal or state agency has extra equipment, seized goods, or foreclosed property, the goods are either transferred to another government agency or sold to the public. These items are sold “as is” by auction or negotiated sale either online, in-person, or both. State governments tend to have a single auction site online, while the federal government has several.

References:

Langerman Panta Rhei. (2017, May 1). Modern IT management: How to do it budgeting right (lecture 5) . Langerman Panta Rhei. https://langerman.co.za/modern-it-management-cost-management-lecture-5/. Retrieved July 31, 2023.

U.S. Small Business Administration. (n.d.). Buy assets and equipment. U.S. Small Business Administration. https://www.sba.gov/business-guide/manage-your-business/buy-assets-equipment. Retrieved July 31, 2023.